Figuring out how to find the perfect home can be both exciting, yet overwhelming at the same time. Owning a home is one of the largest financial milestones, but with the right tips and guidance you can get there. We finally did.

(This post sponsored by my bank of 24 years, Suntrust. All opinions are mine.)

I’ll never forget when we started the search to find our perfect home. Young and eager, newborn in tow, we wanted to put money into a house, rather than continuing to pay rent for our apartment, but it’s not a decision that can be made lightly.

For years, we’d squeaked away money for a downpayment, continually asking the age old question, “Can I afford a new home?” Is this the right time?

These are the factors we had to consider:

- Down payments – We made a goal of 20% down payment, so we kept putting aside some every month until we were there (and yes, we even lived with my parents while the house was being built. ;)) Use this practical Loan Amount Worksheet to figure out what you can afford.

- Closing costs – Can you roll this into your mortgage? That’s always the best idea.

- Moving costs – Unless you’re expenses are paid for through business relocation, this is cold, hard cash out of your pocket, so make sure you anticipate this up front.

- Miscellaneous expenses such as homeowner fees, utilities, repairs and general upkeep – this is critical to consider because it’s not only a matter of affording a new home financially, but also with your time. Do you have the time to own your own home?

- What type of mortgages are available? Talk to your lender on what makes the most sense for you. For us, we were able to lock in our interest rate for a specific period of time and have since refinanced two different times for an even lower rate. Once we could afford to attack the interest, we switched from a 30 year mortgage to a 15 year loan.

- What is our Credit Score? I’ve addressed this previously, so check out my post on important Credit Score information here.

If you’ve evaluated these factors, pretty please take this next piece of advice to heart – don’t buy too much house for your budget. Don’t put yourself in the position where you become so house poor that you’re not ready in case of a financial emergency. Dear friends of ours asked our advice about an amazing house up for sale. We went through their budget and after they’d pay bills and their new mortgage, they had nothing left to spare. We encouraged them to hold off a bit because it might cause unnecessary stress on their family – finances often do – yet they assured us it was an investment (which eventually led to a foreclosure). When we decided on our mortgage amount, we stuck to that amount like our life depended on it. I chuckle as I think how we were picking and choosing which doors in our home would be solid wood and which wouldn’t. Those small details add on thousands.

While owning homes and purchasing land can be an amazing investment, it’s not worth the risk if you can’t afford it. Great deals will come around again when the time is right.

When we finally decided to purchase, we asked “How do we find the perfect home?”

Both in our twenties, with a new baby, and working full time at a church, the hunt was all a bit over my head. We asked ourselves if we were willing to find a fixer upper and put some blood, sweat and tears into it. Honestly, this was before HGTV was even a thing. I had a new baby and while I’ve always been one for spray painting everything in sight, I knew I wasn’t up for knocking down any walls.

Now, bring it on, but then, we considered location, location, location. 🙂 I knew I could make any home, the perfect home for our family.

Here’s a checklist of things to consider as you search to find the perfect home:

» Your commute

» Distance to shopping, parks, restaurants

» Medical care availability

» School district preference

» Neighborhoods, HOAs

» Traffic flow on street

» Value of nearby homes

» Future plans (think ahead to the next five–seven years)

After a year of searching on and off, that last suggestion of future plans threw us a curve ball. We decided to move from Wisconsin to NC and knew the importance of having a mortgage for preferably five years before selling, so we waited and waited.

After an additional three years and two more babies, we got a Suntrust mortgage , dreamed up the perfect home for us, closed on that home and it was all SO THRILLING. (I still get all the feels.) Now granted, it took a few more months to build it, but that excitement, mixed with the permanence of our decision, sticks with you forever.

Instead of shopping around, we decided to build our house based on the dream cast by my dad: to buy lots of acres with my siblings, build houses on the same land, and create a legacy of sorts where over twenty cousins would grow up together. We needed to pack as much square footage as we could into our budget, but forsake the intricate details and unique designs that adds onto a morgage.

We knew we could do that eventually as our finances allowed.

It’s been a journey, first with our front porch that took us 17 years to build and now with the recent purchase of our forty acres. (Have you read about that adventure? Hoping to get my barn someday.)

Now I’m just going to get excited with our eldest son as he begins the process of finding the perfect home for his new bride. (They get married in December. EEK!)

Are you ready to find your perfect home? Are you debating finding a hidden treasure and fixing it up?

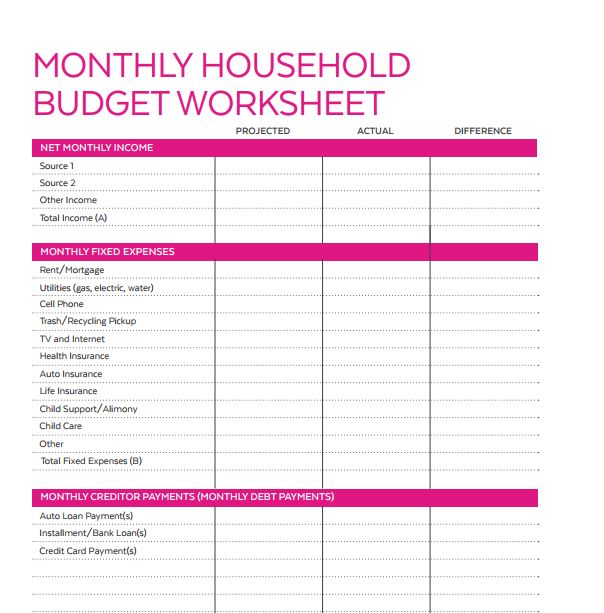

There’s a super Practical Guide for Purchasing a New Home with every tip and idea you need to know before purchasing. It also has printable worksheets that help determine your monthly household budget as well as potential mortgage.

At SunTrust Mortgage, we make it a priority to learn all about your unique circumstances. Confidence starts with a conversation.

Talk with a SunTrust Mortgage expert today.

This post was sponsored, and paid for, by SunTrust Mortgage. All opinions are my own.

I’d love a fixer upper but I know it’s so much work.

I’m the same way. IT looks so easy on the shows,but THE TIME! 🙂

“Don’t buy too much house for your budget.” I love this piece of advice! When we were expecting our first child, we bought a house that was priced considerably below the amount that we were approved for. I’m thankful that we did, because a manageable house note saw us through some tough financial times when we were a young family. Thanks for sharing your wisdom about this important decision.

you’re so welcome!! It’s come through years of learning together. 🙂

I’ve been wanting to move out of my parents home soon because I feel like I’m too old to still be sharing a house with them. I was actually thinking about the things that I need to consider when I read your article. I agree with you that it’s for the best to make sure that I consider the location of the home I’ll be buying. I love shopping so that’s one thing that I’m going to consider when looking for a new house. Thanks for the tips.

Those list of factors were so helpful. My husband and I want to begin our search for a home. We hadn’t considered making a goal towards the down payment. That sounds like a wonderful idea.